VA Home Loans: Exclusive Benefits for Veterans and Active Service Solution Members

VA Home Loans: Exclusive Benefits for Veterans and Active Service Solution Members

Blog Article

Navigating the Home Loans Landscape: How to Leverage Funding Solutions for Long-Term Riches Structure and Safety And Security

Browsing the complexities of home finances is essential for anyone wanting to develop wide range and guarantee economic security. Recognizing the various kinds of financing choices offered, along with a clear evaluation of one's financial scenario, lays the groundwork for educated decision-making. By utilizing critical loaning methods and preserving building worth, individuals can improve their long-lasting wealth possibility. The intricacies of properly utilizing these remedies increase critical concerns concerning the best techniques to comply with and the challenges to avoid. What approaches can truly optimize your financial investment in today's unstable market?

Comprehending Home Financing Types

Home mortgage, a crucial element of the realty market, been available in different kinds made to fulfill the varied demands of consumers. The most common types of mortgage include fixed-rate home loans, adjustable-rate home loans (ARMs), and government-backed finances such as FHA and VA financings.

Fixed-rate home mortgages use security with regular month-to-month repayments throughout the finance term, usually ranging from 15 to thirty years. This predictability makes them a popular selection for new property buyers. In comparison, ARMs include rates of interest that rise and fall based upon market problems, frequently resulting in reduced initial settlements. Nevertheless, borrowers should be planned for potential increases in their month-to-month commitments gradually.

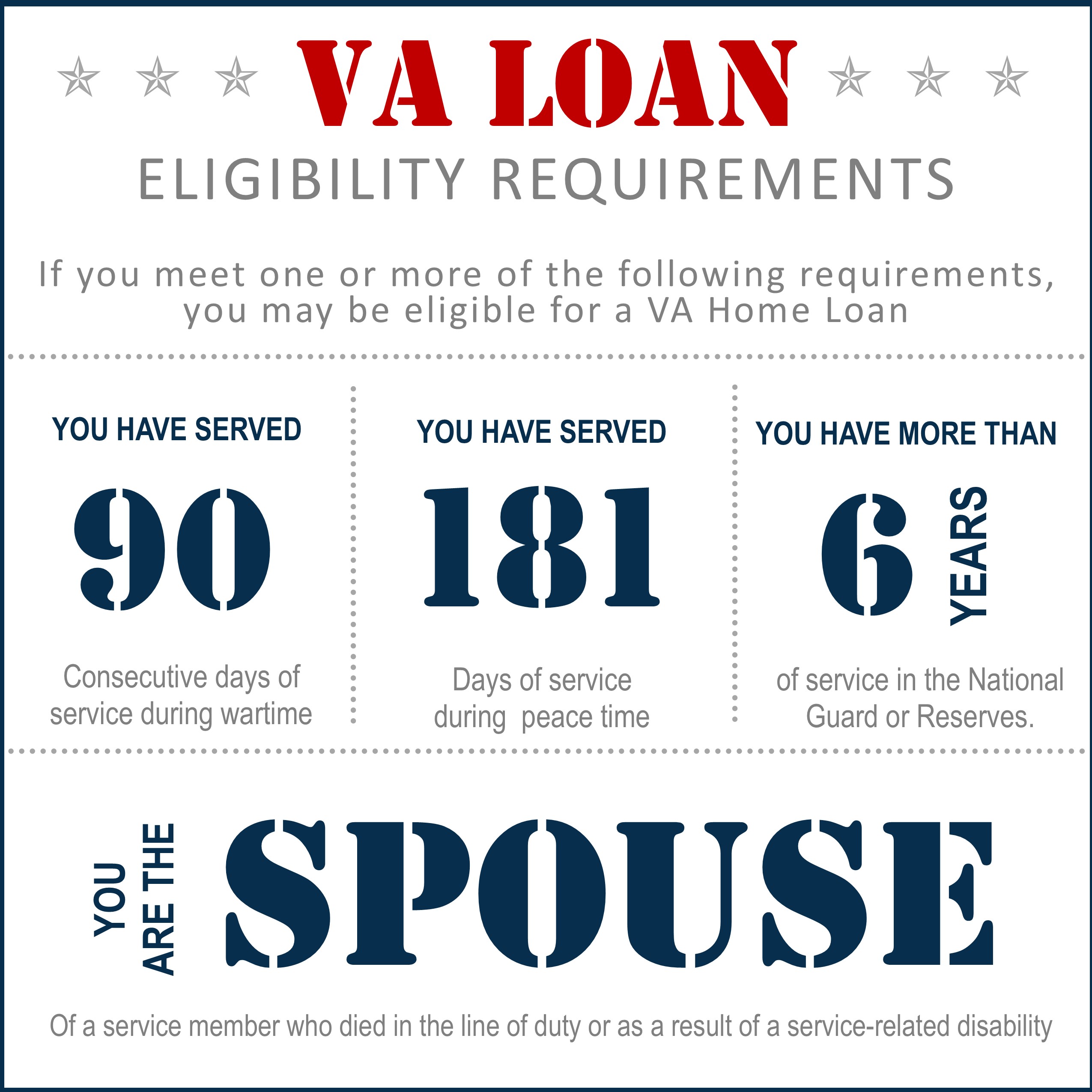

Government-backed finances, such as those insured by the Federal Real Estate Administration (FHA) or ensured by the Department of Veterans Matters (VA), cater to details groups and usually need lower deposits. These fundings can facilitate homeownership for individuals who might not get traditional funding.

Evaluating Your Financial Situation

Assessing your economic situation is an important action in the mortgage process, as it lays the structure for making informed loaning decisions. Begin by examining your earnings sources, including incomes, incentives, and any added earnings streams such as rental residential or commercial properties or investments. This comprehensive sight of your earnings aids loan providers establish your loaning ability.

Following, evaluate your expenses and month-to-month obligations, including existing debts such as credit rating cards, student lendings, and vehicle repayments. A clear understanding of your debt-to-income ratio is crucial, as many lenders favor a proportion below 43%, guaranteeing you can handle the brand-new home loan repayments alongside your existing responsibilities.

In addition, review your credit report, which dramatically affects your funding terms and rates of interest. A greater credit rating shows financial integrity, while a lower score might demand techniques for improvement before making an application for a financing.

Lastly, consider your properties and financial savings, consisting of reserve and liquid financial investments, to guarantee you can cover down settlements and closing prices. By meticulously examining these parts, you will certainly be much better positioned to navigate the home mortgage landscape properly and safeguard funding that aligns with your long-term monetary goals.

Approaches for Smart Loaning

Smart borrowing is vital for browsing the intricacies of the mortgage market successfully. To maximize your loaning approach, begin by understanding your credit scores profile. A strong credit report rating can considerably reduce your rate of interest rates, translating to considerable financial savings over the life of the loan. Frequently monitoring your credit history report and attending to inconsistencies can improve your score.

Next, think about the type of home mortgage that ideal fits your financial situation. Fixed-rate financings offer security, while variable-rate mortgages might give reduced first settlements yet bring dangers of future price boosts (VA Home Loans). Examining your long-lasting plans and financial capacity is essential in making this decision

Additionally, purpose to protect pre-approval from lending institutions prior to home hunting. When making an offer., informative post this not only provides a clearer picture of your spending plan however likewise reinforces your negotiating placement.

Long-Term Wide Range Building Strategies

Building long-term riches via homeownership calls for a calculated strategy that exceeds just protecting a home loan. One efficient strategy is to consider the gratitude capacity of the residential property. Picking homes in expanding neighborhoods or areas with prepared developments can result in significant boosts in residential property value over time.

Another important element is leveraging equity. As home loan repayments are made, homeowners develop equity, which can be used for future investments. Utilizing home equity lendings or credit lines sensibly can give funds for added genuine estate financial investments or improvements that better boost property value.

In addition, preserving the building's problem and making strategic upgrades can significantly add to long-lasting wealth. Straightforward improvements like energy-efficient devices click over here or modernized restrooms can yield high returns when it comes time to market.

Last but not least, comprehending tax advantages connected with homeownership, such as mortgage passion deductions, can boost economic results. By optimizing these advantages and adopting an aggressive investment way of thinking, property owners can grow a durable profile that fosters long-lasting riches and security. Eventually, an all-round strategy that prioritizes both property choice and equity monitoring is necessary for sustainable riches structure through property.

Maintaining Financial Security

Additionally, fixed-rate home loans provide predictable monthly payments, allowing better budgeting and economic preparation. This predictability safeguards house owners from the changes of rental markets, which can cause abrupt boosts in housing prices. It is necessary, nevertheless, to make sure that home loan payments continue to be workable within the broader context of one's economic landscape.

In addition, accountable homeownership involves normal upkeep and enhancements, which safeguard residential property worth and improve overall protection. Homeowners should additionally take into consideration expanding their economic portfolios, guaranteeing that their investments are not only tied to real estate. By integrating homeownership with other monetary tools, individuals can develop a balanced strategy that reduces threats and enhances general financial security. Inevitably, maintaining monetary security through homeownership calls for a enlightened and proactive method that stresses careful planning and recurring persistance.

Final Thought

In conclusion, properly navigating the home financings landscape demands a detailed understanding of various lending kinds and a thorough analysis of private financial scenarios. Executing strategic loaning practices facilitates long-lasting wealth buildup and protects financial security.

Navigating the intricacies of home car loans is essential for any person looking to construct wealth and ensure monetary security.Examining your financial scenario is a critical step in the home loan process, as it lays the structure for making notified borrowing choices.Homeownership not just offers as an automobile for lasting riches building yet also plays a substantial function look at these guys in maintaining monetary security. By integrating homeownership with various other financial tools, individuals can produce a well balanced approach that reduces threats and improves general economic stability.In conclusion, successfully browsing the home finances landscape demands an extensive understanding of different financing types and a complete assessment of individual financial scenarios.

Report this page